- #ACCOUNTS RECEIVABLE TURNOVER RATIO FULL#

- #ACCOUNTS RECEIVABLE TURNOVER RATIO SOFTWARE#

- #ACCOUNTS RECEIVABLE TURNOVER RATIO PLUS#

- #ACCOUNTS RECEIVABLE TURNOVER RATIO SERIES#

#ACCOUNTS RECEIVABLE TURNOVER RATIO FULL#

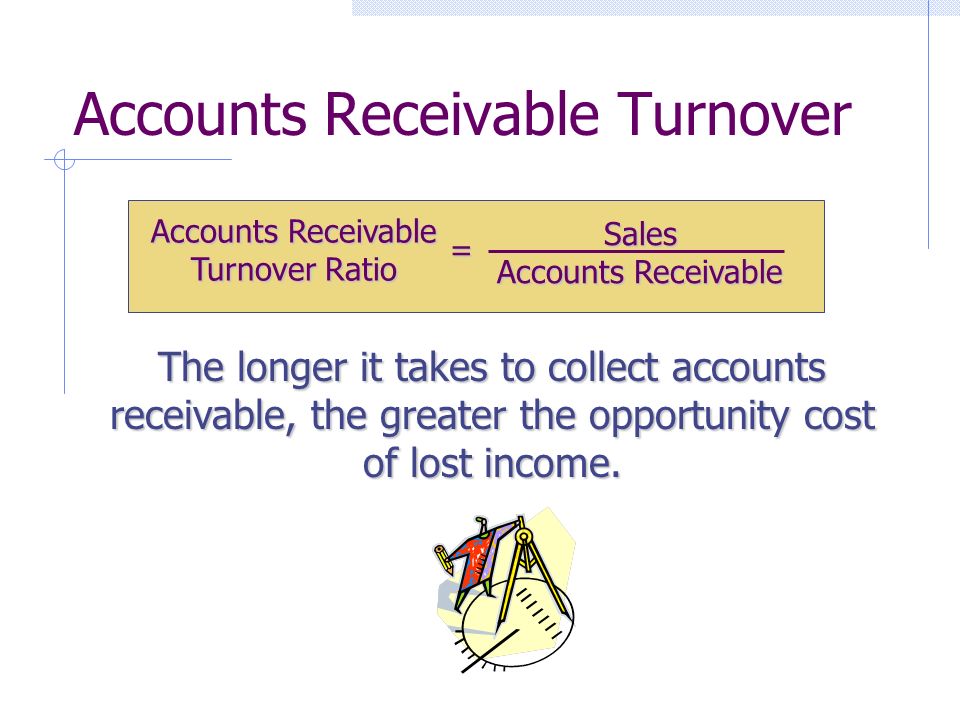

Therefore, credit sales differ from cash sales where customers need to make a full payment on the date of the sale. This means that while a customer purchased a product or service without sufficient cash at the time of the transaction, they won't pay for the sale until several days or weeks after the fact. What are credit sales on a balance sheet?Ĭredit sales refer to a sales transaction wherein a payment gets made at a later date.

#ACCOUNTS RECEIVABLE TURNOVER RATIO PLUS#

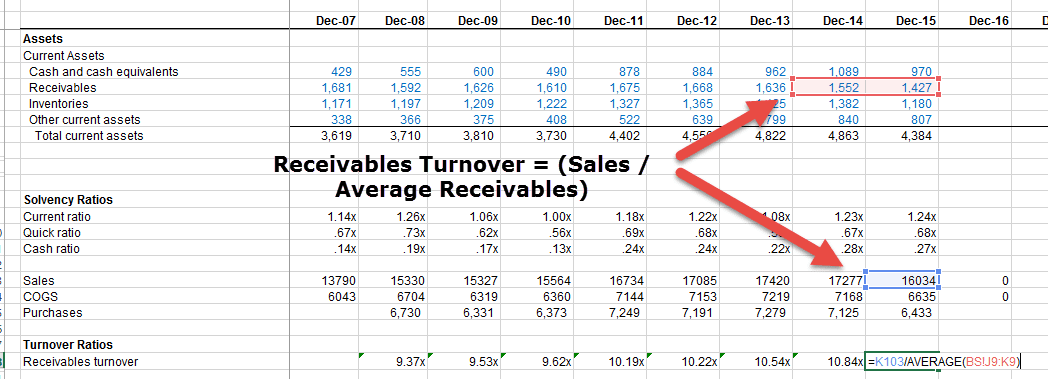

In this article, we define credit sales and net credit sales, plus the accounts receivable turnover ratio, explain where to find a business’s credit sales on a balance sheet and list the steps for calculating credit sales. Performing this calculation helps you analyze your company's selling practices. Not only do you need to know your company's cash sales, but you also need to know the amount of credit sales it's had during a given time period. When you own a business, it's important to have the most accurate picture of your company's financial performance.

#ACCOUNTS RECEIVABLE TURNOVER RATIO SOFTWARE#

The implementation of such a software can revolutionize a business?s account receivable process and boost their financial performance at the same time.A business owner looks over a tablet as customers are seen in the background browsing the shop. This manager should also coordinate with different teams within the organisation such as finance, IT and operations who will be utilizing the Order To Cash Software.īy following these steps and considering all the pertinent factors, businesses can ensure they select the most optimal Order To Cash Software provider and maximize their credit turnover ratio.

During the implementation phase, a project manager should be assigned and coordinate the process with the selected vendor. In addition, it is important that businesses select a vendor that is proactive in providing the latest updates and releasing new features to ensure their business is always on the forefront of financial technology.įinally, after the selection of a vendor has been made, the implementation process should begin. Selection should take into account cost-effectiveness, scalability and any additional features that provide added value to the business. Once the demos and research have been conducted, it is time to make a decision and select the most suitable Order To Cash Software. Additionally, they should ask the vendor for references from other firms using the software, so they can gain firsthand knowledge and understanding of the level of quality and outcomes these firms have experienced. Businesses can use this opportunity to ask questions and determine which solution meets their criteria the best.

#ACCOUNTS RECEIVABLE TURNOVER RATIO SERIES#

The next step in the evaluation process involves conducting a series of online demos with the shortlisted vendors. In order to do this, they should read up on solution capabilities, user reviews and white papers provided by the vendor to gain an understanding of their software and business philosophies. By researching the vendors offering these solutions online, decision makers should compose a shortlist of potential vendors that fit their objectives.

It is also important to consider scalability, future proofing and cost-effectiveness when comparing providers and deciding on a vendor.įollowing the establishment of evaluation criteria, businesses should begin reviewing potential Order To Cash Software providers. Some critical criteria to consider include software features such as automated payment collections, time-saving invoicing functionalities and credit risk to monitor customer payment behaviour. To maximize the opportunity for businesses to improve their credit turnover ratio with Order to Cash Software, it is critical that decision makers understand the process of evaluating and selecting the most suitable system.įirstly, firms evaluating possible Order to Cash Software need to establish evaluation criteria that reflect their desired outcomes and align with their strategic financial objectives. For the C-Suite executive in Finance, the implementation of Order to Cash Solutions can rapidly increase the credit turnover ratio for any business interested in optimizing their accounts receivable process.

0 kommentar(er)

0 kommentar(er)